10 Reasons Why It’s a Great Time for Fintech

Gina

Founder & co-CEO

4 min

May 6, 2020

How the financial world meets entrepreneurship and digitalization.

We live in interesting times, where financial instability is coupled with opportunity. Therefore adapting your business and/or investment mindset to the current developments with enhanced flexibility is crucial.

At Wolfpack Digital, we are witnessing an increased interest from our clients to build new and revolutionary fintech solutions, that either digitalize/automate existing systems or simply improve the experience of handling financial transactions, operations, and investment. Our commitment to fintech can be seen in the many fintech apps we’ve built and in our active sharing and participation in the Finimize community, which is the biggest finance community in the world. As the founder and CEO of Wolfpack Digital, I was invited as a speaker to share my experience working with the industry a few weeks ago in front of the enthusiastic Finimize community in Cluj, and I loved every second of it. The topic was centered around how the financial world meets entrepreneurship and digitalization.

Here are a few thoughts from my presentation, that I delivered going beyond buzzwords such as blockchain and cryptocurrencies, and focusing on what’s great and what to be mindful of when building fintech apps.

- As an app development company, we’ve seen a rise in the interest to build fintech apps since 2018, and the trend is rising during the early months of 2020, as the world faces the Covid-19 pandemic.

- Banking as a service is becoming more and more popular. At Wolfpack Digital, we really look forward to seeing Ikigai go live in the upcoming months! Ikigai is a UK-based digital private banking solution we’ve been working on for the past year, and in our opinion, it is going to be a huge game-changer in its market.

- The world is going cashless and more digital, which results in changes in financial laws and regulations. This affects consumer behaviour in traditional areas, such as fundraising events organised by charities, donation-behaviour etc. GoodBox is a contactless fundraising solution embraced by organisations and entities such as Mayor of London, Tate, Church of England, and many more. We’ve had the opportunity to be involved in building the web dashboard for charities at the beginning of the story of this absolutely great company. Cheerify is another great example of a mobile app we’ve helped build that equates content creation and fundraising opportunities.

-

Globalisation leads to greater uniformity in the financial climate, with EU-common policies and the global trading impacting the way governments shape their policies. The recent EU PSD2 Open Banking directive is opening many new doors for innovation and innovative minds.

-

There is a great opportunity in the way the regulatory climate is changing. For example, laws regarding tipping are changing in many countries, which creates space for web or mobile apps to facilitate easier management of splitting tips, etc.

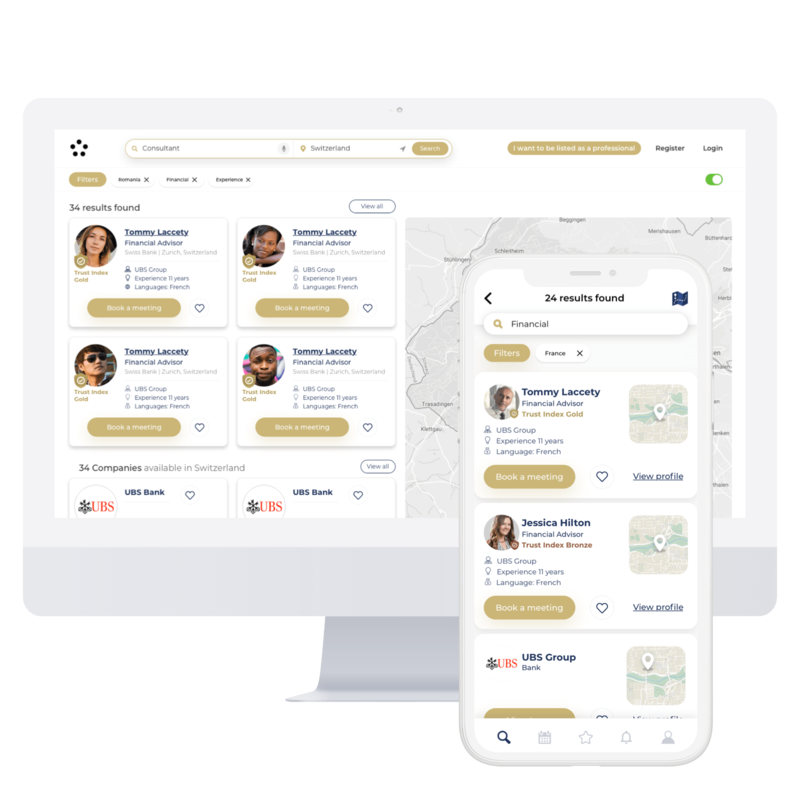

- There are areas that are unexplored to various extents or un-digitized, such as investment monitoring and the potential automation of resulting legal actions. Have a look at what the hot InvestorRecourse startup is doing. The startup is led and founded by Mario Lattuga, who is an ambitious and visionary NYC-based lawyer we’ve had the opportunity to meet last year at Wolfpack Digital. Planet of Finance is another example of an award-winning web and mobile platform based in Monaco that brings together high-profile investors and advisors making interaction easier.

7. More and more people are interested in stocks, in reducing time spent trading, and in cutting commissions and transaction costs. Commission and time optimization is key and consumers are highly interested in it. The general trend is that of reducing entry barriers for everyone to invest in the stock market, with companies such as Revolut committing to making investment more affordable and accessible for everyone by allowing buying fractions of shares.

8. Knowledge in terms of regulations is essential, especially when building apps that rely on new laws and directives. As an entrepreneur or a business representative looking to build a fintech app, you need an expert advisor who is highly knowledgeable on the specific financial niche or opportunity you are focusing the digital product on. Relying on new regulations for your fintech product is a high-potential, yet high-risk combination, and therefore extra attention is needed.

9. Make sure you are aware of the costs involved in licensing in particular, as this can make or break your business idea and plan. Banking, trading or gambling licenses come with costs and, sometimes, with blockers and battles that might be highly impactful on your business.

10. Having a strong and certified tech partner with experience in building financial or fintech solutions is a huge plus on your journey building a fintech product. It also significantly increases your chances of success, with security and quality being two essential aspects of your journey together.

And the great news is that there are some great software development potential partners out there. At Wolfpack Digital, not only are we ISO 270001 and ISO 9001 certified for security and quality, but our experience in the field and our contribution to making fintech projects successful helps us serve fintech startup founders and company representatives better not just technically, but also in terms of product strategy and design.

That’s it, folks! Thank you for reading and curious to see how fintech will shape the future for everyone! If you have any questions or just want to have a friendly conversation about fintech, we’re always here!

pack knowledge

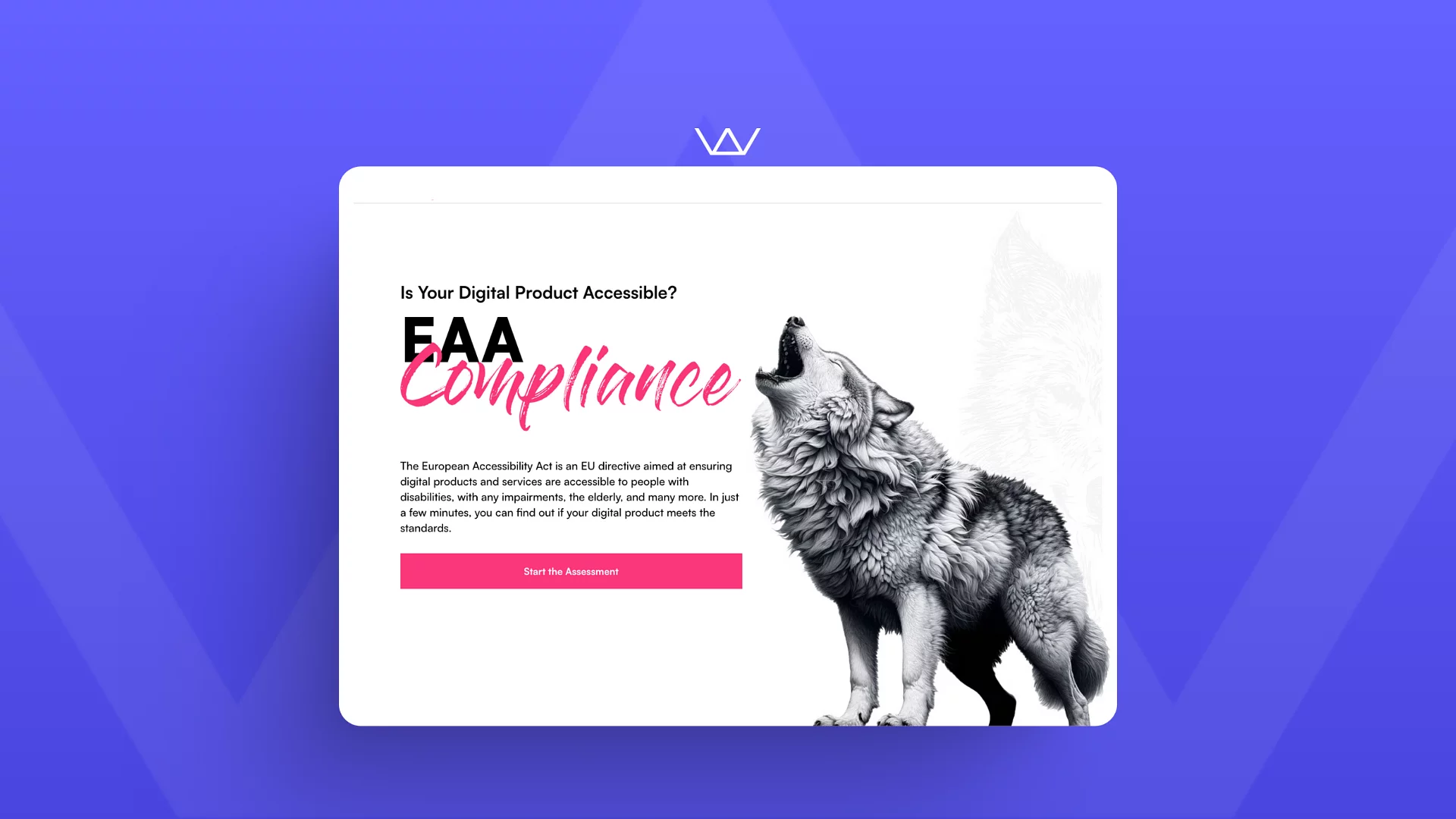

Is your digital product ready for the European Accessibility Act (EAA)? Take the assessment to find out!

Oana

Marketing Specialist

5 min

Mar 20, 2025

With the 2025 deadline approaching, ensuring your website or app meets accessibility standards is important. Our free EAA assessment helps you quickly check compliance and identify areas for improvement. At Wolfpack Digital, we specialize in making digital products accessible, user-friendly, and future-proof. Take the assessment today and ensure your platform is inclusive for all users!

How Much Does Web Development Cost? A Complete Guide

Oana

Marketing Specialist

10 min

Feb 26, 2025

Building a website is more than just designing pages—it’s about creating a functional, high-performing, and scalable digital presence that meets your business goals. Whether you're launching a simple business website, an e-commerce store, or a custom web platform, the cost and approach will vary based on complexity, functionality, and long-term needs.

UX/UI Design: Collaborating with a Software Development Agency When You're New to the Game

Cristian

Head of UX/UI Design

7 min

Feb 18, 2025

This guide will walk you through every stage of the UX/UI design process, from the initial conversation to launching a product you can be proud of. Understanding the design thinking process, which includes empathizing, defining, ideating, prototyping, and testing, is crucial for creating user-friendly products and solutions.

Brief us and let’s work together